Create change with your donors’ spare change

MyChange is an easy way for forward-thinking people to feel good by doing good — every day.

How MyChange Works

MyChange rounds up your donors’ daily debit or credit card transactions to the nearest dollar and donates the difference in change to your organization or cause.

Lunch $8.23

Supporters use their card anywhere

Round up $0.77

MyChange rounds up to the next dollar

Create Change

MyChange sends the round-up to your organization

Donors connect the debit or credit card they want to use.

Donors spend like normal and MyChange rounds up the change.

Watch as your donor base grows in support of your cause.

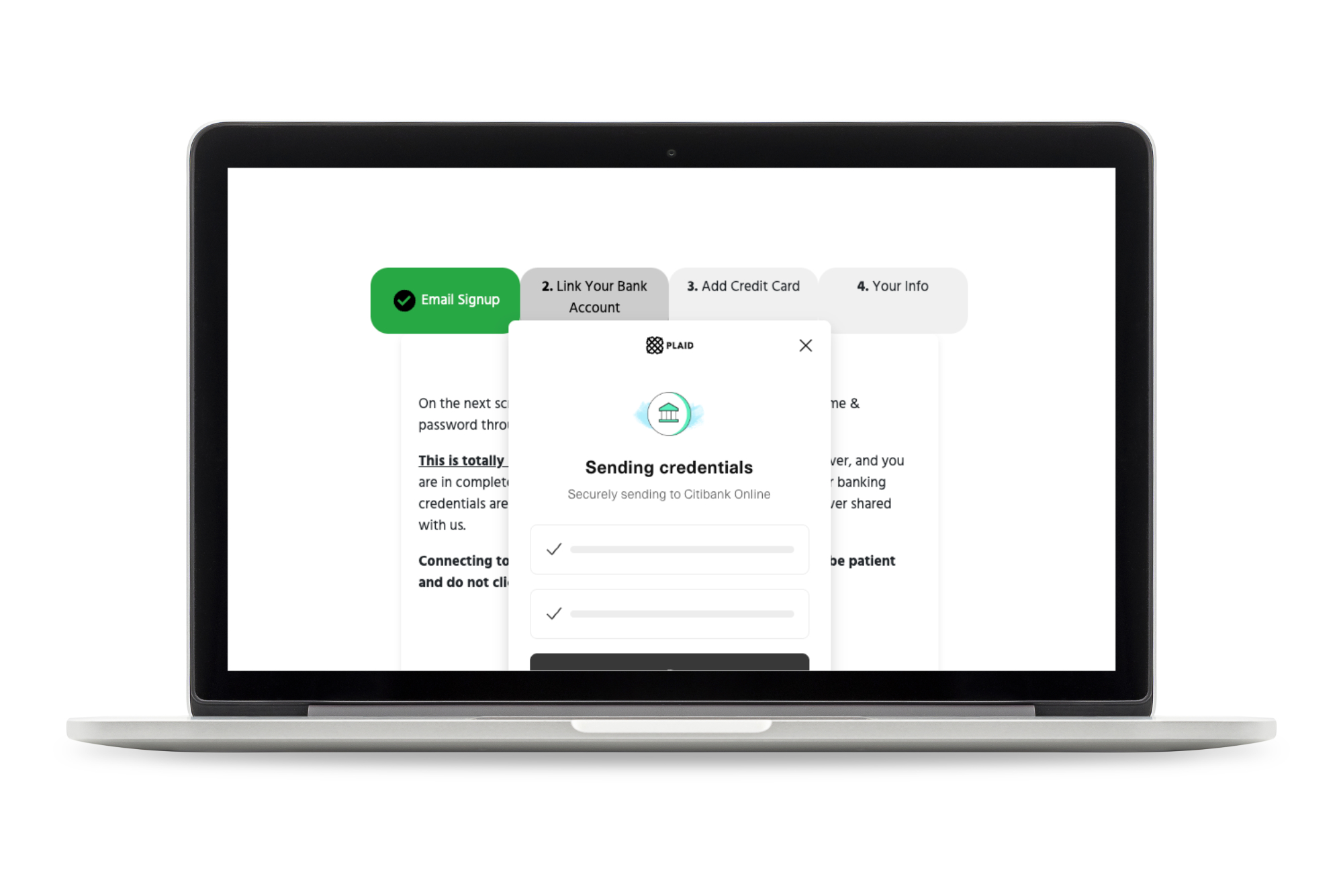

MyChange takes security and privacy seriously.

MyChange utilizes bank industry security standards and is built with America’s most trusted financial technology, working with all of the largest banks, 9,000 smaller financial institutions, and millions of consumers. We do not store your donors’ bank login information on our servers, and no transactions occur on our servers. We will never sell or rent your donors’ personal information to anyone, for any reason, at any time.

What if you could convert your occasional donors into recurring $20-$30 monthly donors at no cost to you.

MyChange will create a branded landing page for your organization’s donors making sign-up easy.

EASY SIGN UP PROCESS

Simple registration optimizes onboarding and allows the donor to change their own bank and card information anytime from the portal.

YOUR BRANDING THE WHOLE WAY

The entire sign-up process looks and feels like part of your website so your donors are led through registration on our site without feeling confused about whom their round-up will go to.

LOW COST

Our fee structure is affordable and can fit any size organization, whether you are just starting out, or an established organization.

Micro-donations & Round-up Tech: The Millennial Way to Give

Higher Average Monthly Donation

On average, round-up tech companies like Acorns or Chipper generate $20-$30 a month per users.

Consistent Cashflow

Applied to nonprofits and political fundraising, round-up technology can create a previously untapped stream of predictable cash flow through micro-donations.

We All Work Together

Micro-donations collected with round-up tech offer the modern philanthropist an easy and seamless way to contribute to their community.

Research shows that Millennials and Gen-Zers are among the earliest adopters of new e-commerce technology, including round-ups.

MyChange simplifies the path to more monthly recurring donors by making the donation process easy and hands-off

How It Works

Supporters sign up by linking their bank account and credit or debit card through MyChange.

At the end of each month, the total change from all transactions are tallied and a donation is sent directly to your organization.

MyChange uses Plaid and Stripe as payment partners to provide the strictest levels of data privacy and regulatory compliance.